Inflation's rise is MMT's demise

How our current economic woes reveal the folly of Modern Monetary Theory

The premise of Modern Monetary Theory is relatively simple. In a nutshell, it’s simply this: The government can print as much money as it wants to fund government programs.

One common criticism of MMT is that if the government prints too much money, it will result in inflation — a rise in prices caused by too many dollars chasing too few goods and services. MMT proposes a solution to that problem. If the economy overheats as a result of the government printing too much money, it can raise taxes to take money out of the economy, thereby taming inflation.

Despite occupying a fringe position in the field of economics, MMT’s popularity has grown in recent years thanks to proponents like Stephanie Kelton and her pop-econ book, The Deficit Myth, and the theory’s popularity with trendy leftwing politicians like Alexandria Ocasio-Cortez and Bernie Sanders.

But the events of the last year have cast out all doubt: MMT does not work when put into practice, and further enacting policies inspired by the fringe economic theory would have disastrous consequences for the U.S. economy.

Spending gets out of control

When it became clear at the beginning of 2020 that the COVID-19 pandemic was a serious matter, the U.S. government responded by passing the largest stimulus spending package in U.S. history. President Donald Trump signed the $2.2 trillion CARES Act into law on March 27, 2020. The massive spending bill included $300 billion in one-time cash payments to millions of Americans, $260 billion in enhanced unemployment benefits, and $350 billion for the Paycheck Protection Program (PPP). Trump signed off on $900 billion in additional aid in December 2020.

Not to be outdone — and proving that reckless federal spending is a bipartisan affair — President Joe Biden signed the $1.9 trillion American Rescue Plan into law in March 2021. The hefty stimulus package included more than $400 billion in additional cash payments to American citizens, $350 billion in (unnecessary) aid to state and local governments, and $14 billion for vaccine distribution.

Altogether, the government spent a jaw-dropping $5 trillion on COVID relief in 2020 and 2021. Biden wanted to pass even more, but his $1.9 trillion Build Back Better bill never gained traction, largely due to opposition from moderate Democratic Sen. Joe Manchin.

There’s a lot to criticize in all this reckless spending. Stimulus payments were sent out to all taxpayers and Social Security recipients, whether they needed it or not, and the government sent $1.4 billion in checks to dead people. Enhanced unemployment payments paid people thousands of dollars each month on top of what they had been making at their jobs, which created a perverse incentive not to go back to work, even when it was safe to do so (which has contributed to the ongoing labor shortage, which has further exacerbated inflation by increasing businesses’ labor costs). And the New York Times reported that before the end of 2020, investigators had uncovered $62 million in fraud in the PPP program.

But for MMT proponents, such massive spending was just what the doctor ordered. In fact, in their view, it didn’t go far enough: In a March 2021 interview shortly before Biden signed the American Rescue Plan into law, Kelton suggested making the spending glut permanent, saying that poverty is a “policy choice” that Congress can change “with a piece of legislation, with a further commitment, with a doubling down on some of these programs that make them permanent and that demonstrate the government is committed not just to alleviating strain in a time of crisis, but to fundamentally eradicating poverty in this country.”

But it was clear to keen observers that the government’s reckless spending would almost inevitably lead to inflation. Harvard economist Larry Summers has been one of the most vocal and prominent voices warning of inflation; in a March 24, 2021 New York Times article, he stated, “I think there’s a one-third chance that inflation expectations meaningfully above the Fed’s 2 percent target will become entrenched, a one-third chance that the Fed will bring about substantial financial instability or recession in order to contain inflation, and a one-third chance that this will work out as policymakers hope.”

But Summers was outnumbered by economists telling the public they had nothing to fear. A June 2020 Reuters article, for example, proclaimed that economists predicted that the legacy of COVID-19 would be “weak global inflation.”

The article quotes ING economist Robert Carnell as saying, “Once the pandemic subsides, disinflation is the bigger worry as the pandemic is currently the main progenitor of supply friction … Any inflation spikes should be temporary and give way to lower inflation or a lower price level after their initial impact.”

Denial, then begrudging acceptance

The Biden administration scoffed at predictions that the government’s massive stimulus would overheat the economy, even when inflation predictably began to rise. Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell both called inflation “transitory,” predicting that prices would soon go back down.

But inflation has been both high and persistent. By June 2022, inflation had risen 8.3 percent over the past year, far higher than the Federal Reserve’s target of 2 percent inflation.

On June 7, Yellen acknowledged she and Powell were wrong to refer to inflation as “transitory.” She told the Senate Finance Committee during a hearing, “I do expect inflation to remain high although I very much hope that it will be coming down now. I think that bringing inflation down should be our number one priority.”

As recently as June 17, Biden continued to deny that the American Rescue Plan bore any significant role in inflation, saying, “You could argue whether it had a marginal, minor impact on inflation. I don’t think it did. And most economists do not think it did. But the idea that it caused inflation is bizarre.”

Yellen, too, is in denial about the stimulus package’s role in inflation, blaming supply chain bottlenecks instead. While that is undoubtedly part of the equation, there is also little doubt government spending has played a significant role in rising costs, as even left-leaning outlet Vox acknowledged in its article, “Biden’s American Rescue Plan worsened inflation. The question is how much.”

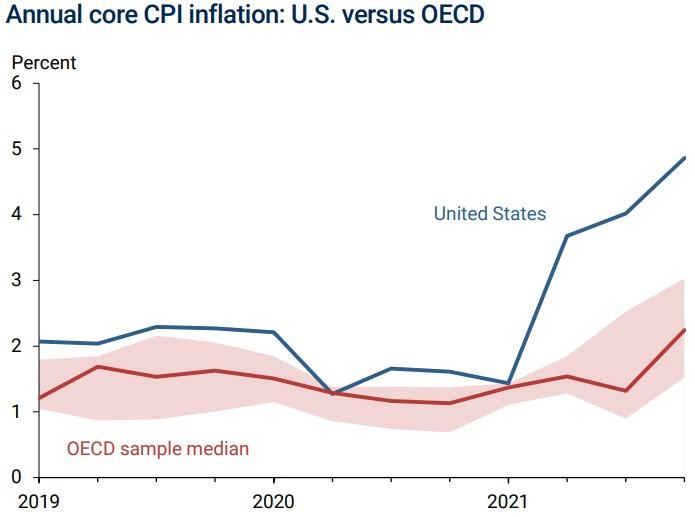

Yellen pointed to inflation in other countries as evidence that government spending wasn’t a primary contributor to U.S. inflation. But there are two problems with that argument: First, other countries passed stimulus packages as well, so it’s disingenuous to blame all their inflation solely on supply chain woes when they artificially stimulated demand through their own spending. Still, they didn’t spend as much as the U.S., which leads to the second problem with Yellen’s argument: Inflation is significantly higher in the U.S. precisely because we spent so much more on COVID stimulus.

According to the Federal Reserve Bank of San Francisco, the U.S.’s stimulus spending may have added 3 percentage points to the country’s inflation rate by the end of 2021 compared to other OECD countries.

The Russian invasion of Ukraine in February has served as another scapegoat for the Biden administration; Biden frequently referred to rising gasoline prices following the invasion as “Putin's price hike,” for example. Although the military conflict has undoubtedly contributed to supply chain constraints, Biden is trying to lay far too much blame at Putin's feet. Inflation was up 7.5 percent in January 2022, the month before the invasion. It's clear that something else is responsible for the bulk of the rise in inflation.

The path to ruin

Proponents of government spending have insisted that the economy is roaring along despite high inflation, citing wage increases and low unemployment. But wage increases don’t tell the whole story; when adjusted for inflation, real wages are actually down. The Bureau of Labor Statistics reported that seasonally adjusted real hourly earnings fell 2.4 percent from December 2020 to December 2021. There’s no doubt about it: Inflation is making people poorer.

Inflation also puts us at risk of going into a recession, because in order to tame it, the Federal Reserve must raise interest rates. That slows the economy, and although the Federal Reserve believes it can stick a “soft landing,” such a best-case scenario is far from guaranteed, and there is a serious risk of recession. It’s a real “damned if you, damned if you don’t” situation — one ultimately caused by the massive amount of money the federal government pumped into the economy.

Proponents of MMT have often claimed that their theories have never been properly put to the test. For example, Kelton claims that the recovery from the 2008 recession was slower than it should have been, because the stimulus package Obama signed into law was too small. If only the federal government hadn't been constrained by an outdated adherence to austerity, MMTers claim, the economy would have quickly come roaring back.

MMTers will claim that the massive COVID stimulus bills, too, were not truly representative of their theory. They are wrong, or, worse, disingenuous. These bills represented exactly the kind of massive spending they believe is necessary to usher in economic paradise. Instead, it has brought us nothing but economic ruin.

In theory, MMT holds that the government can tax its way out of inflation. But there are two problems with that idea. First, it is not always politically feasible to raise taxes.

The disastrous economic impacts from runaway federal spending are a learning opportunity. It would be downright insane — economic suicide, essentially — to continue spending billions or trillions more, like MMT would suggest we do (and which Congress has foolishly done, passing the $740 billion Inflation Reduction Act which is expected to, at best, have no effect on inflation).

It's time we stopped listening to the proscriptions of MMT and started following the proscriptions of reality. That would suggest that the federal government reign in spending to a manageable level, and let the free market do what it does best: Create wealth and prosperity through free exchange. The government can't spend its way to prosperity, and it can't tax its way out of inflation.

It's time to stop making believe that it can.